@parkevtatevosiancfa9544

YouTube

Avg. Quality

74

Success Rate

8.02

Analysis

262

Correct

21

Fail

56

Pending

170

Ineffective

0

Total Quality

Score

If You Had Traded on This Analysis…

Pending

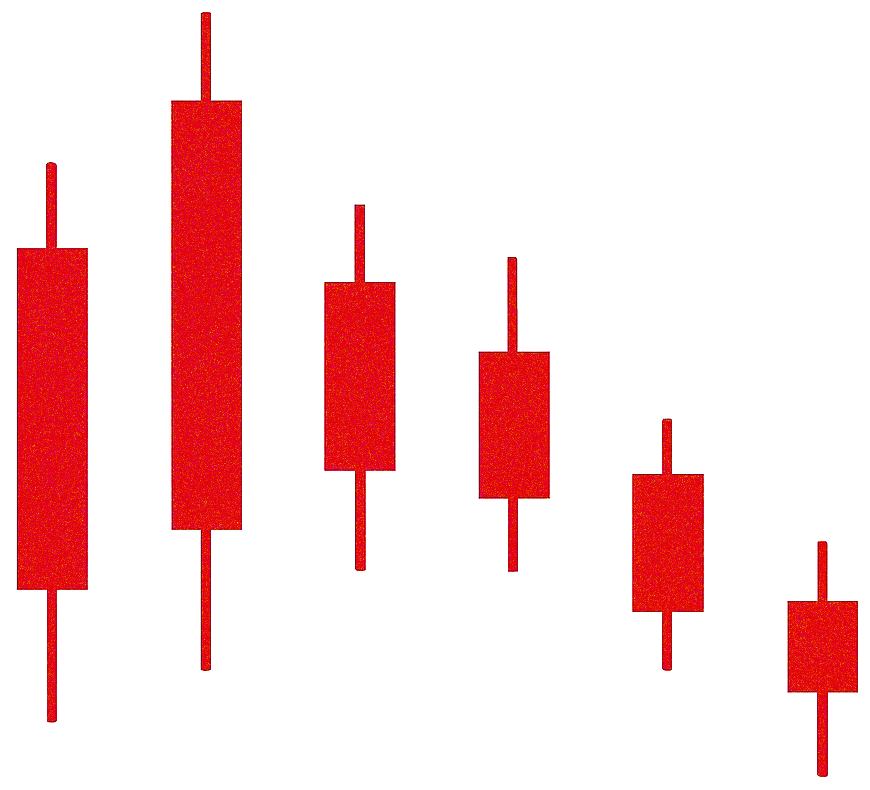

COST

Short Entry

915.8000

2025-09-26

23:57 UTC

Target

837.2500

Fail

950.0000

Risk/Reward

1 : 2

Turn Signals into Profit

Join Tahlil Plus Pro to unlock full performance history, live alerts, and AI-backed risk tools.

Start Free

Live PnL

—

P/L: —

Turn Signals into Profit

Join Tahlil Plus Pro to unlock full performance history, live alerts, and AI-backed risk tools.

Start Free

Costco's Q4 2025 net sales increased 8% to $84.4 billion, exceeding the typical quarterly revenue growth. Comparable store sales rose 5.7%, with the U.S. lagging at 5.1%. Despite having 914 warehouses worldwide, Costco's growth potential is significant, especially in China where it only has 7 locations. While total revenue rose from $79.7 billion to $86.156 billion, operating income only increased by $300 million. Merchandise costs are the cause, up from $69.588 billion to $75 billion. The net income of the company is almost doubled in the year. Discounted cash flow valuation model suggests an intrinsic value per share of $837.25, while the current market price is $943.31. With a forward P/E of 49, Costco is overvalued compared to Amazon, Nvidia, and other tech companies. The analysis sets a sell recommendation because of the high valuation.