Total Quality

Score

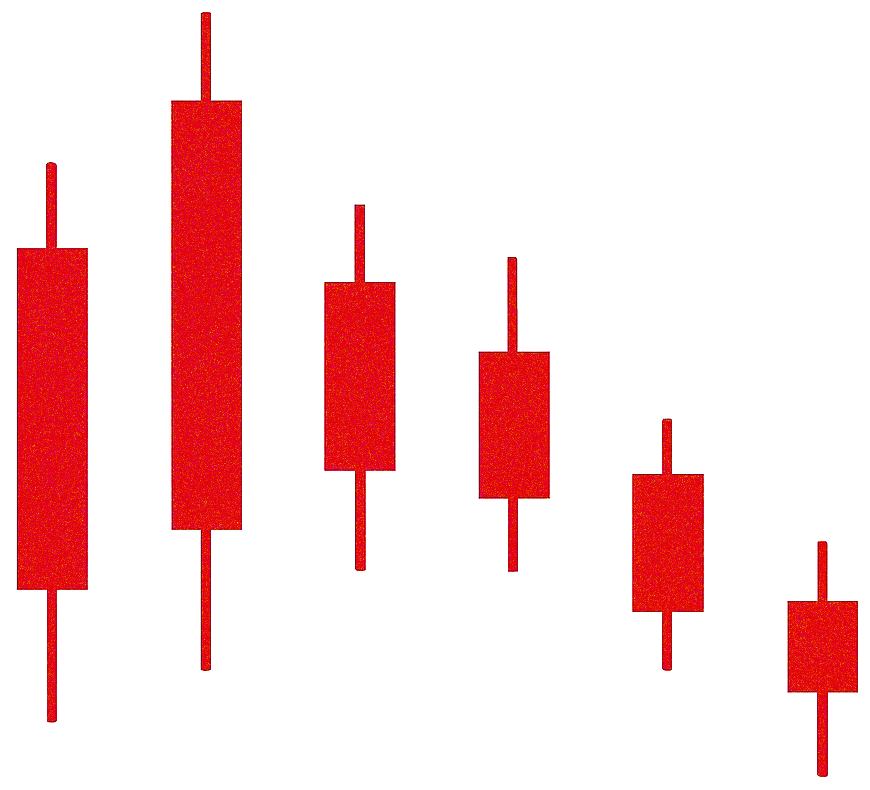

If You Had Traded on This Analysis…

Fail

BTCUSDT

Entry

105,200.0000

2025-06-04

18:01 UTC

Target

35,000.0000

Fail

25,000.0000

In 59 Minutes

Risk / Reward

1 : 1

Turn Signals into Profit

Join Tahlil Plus Pro to unlock full performance history, live alerts, and AI-backed risk tools.

Start Free

Final PnL

76.24%

P/L: —

Turn Signals into Profit

Join Tahlil Plus Pro to unlock full performance history, live alerts, and AI-backed risk tools.

Start Free

Body

The video discusses the Bank for International Settlements' (BIS) perspective on cryptocurrency and its implications for central bank control. The BIS views crypto's parallel financial system as a threat, particularly concerning cross-border flows. It champions Central Bank Digital Currencies (CBDCs) as a public alternative to private cryptocurrencies, highlighting increased regulatory attention to the crypto space, with discussions about potential risks to monetary sovereignty. The BIS reports high cross-border crypto volumes, $2.6 trillion in 2021, primarily Bitcoin, Ether, and stablecoins, which leads to potential adoption in countries with volatile exchange rates, such as Turkey and Brazil.

However, this has now shifted and with a more data-driven approach where capital flow management may be innefective. Bitcoin adoption appears higher in the US, and tether is used more internationally. The video analysis infers a shift towards more regulation, and a long term bullish trend for crypto even with the BIS attempts to contain it with CBDCs.