Total Quality

Score

If You Had Traded on This Analysis…

Pending

BTCUSDT

Entry

103,262.0000

2025-06-05

18:01 UTC

Target

170,000.0000

Fail

90,000.0000

Risk / Reward

1 : 5

Turn Signals into Profit

Join Tahlil Plus Pro to unlock full performance history, live alerts, and AI-backed risk tools.

Start Free

Live PnL

—

P/L: —

Turn Signals into Profit

Join Tahlil Plus Pro to unlock full performance history, live alerts, and AI-backed risk tools.

Start Free

Body

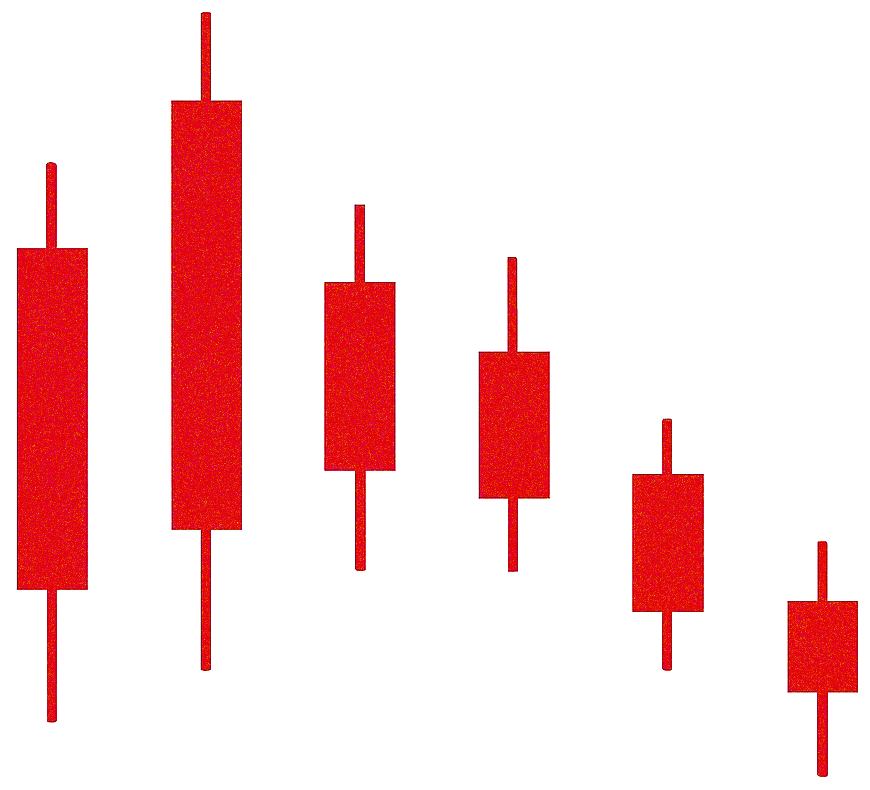

The video analyzes top risks to Bitcoin which include rising leverage, BTC holdings concentrated among a few entities, quantum computing attacks, rising bitcoin-backed loans, more wrapped bitcoin in DeFi protocols. Build-up in Bitcoin-related leverage, concentration of holdings, and the threat of quantum attack. Coinbase is rolling out USDC loans backed by Bitcoin. Zapo Bank to launch Bitcoin-backed loans. Strike to offer Bitcoin collateralized loans. Tether accounts for almost 75% of CeFi lending market. The video analyzes CeFi and DeFi lending, mentioning several Cefi lending programs. Mention of over 166,000 Bitcoin are used in DeFi protocols mostly as collateral for borrowing. Finally mentions about potential liquidations will push Bitcoins prices down. Bitcoin could be dynamite on the way down. The increase in more accessible wrapped Bitcoin, explosion in Defi lending, risk in retail borrowers and retail loan liquidations could trigger institutions Bitcoin back loan liquidations.