Total Quality

Score

If You Had Traded on This Analysis…

Pending

NVDA

Entry

177.2600

2025-08-22

17:23 UTC

Target

149.4100

Fail

179.3000

Risk / Reward

1 : 14

Turn Signals into Profit

Join Tahlil Plus Pro to unlock full performance history, live alerts, and AI-backed risk tools.

Start Free

Live PnL

—

P/L: —

Turn Signals into Profit

Join Tahlil Plus Pro to unlock full performance history, live alerts, and AI-backed risk tools.

Start Free

NVDA

Pending

Body

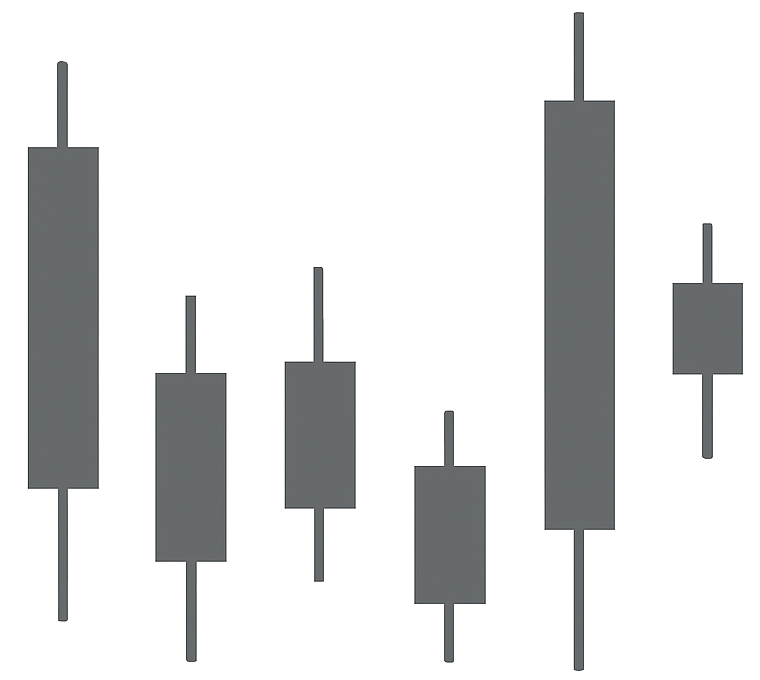

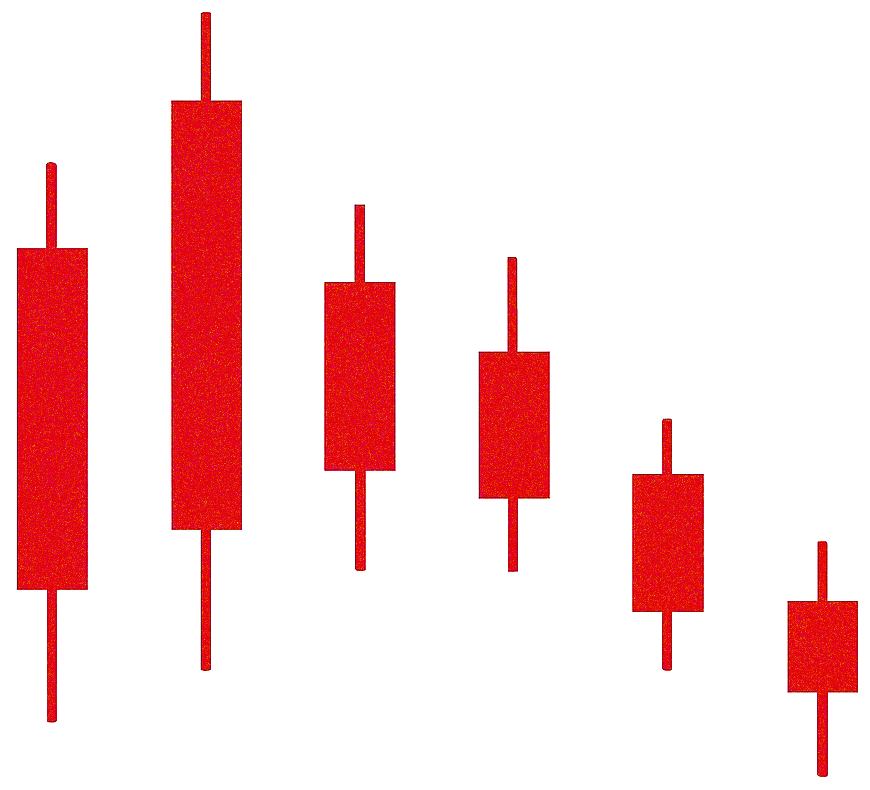

The analysis focuses on NVDA, stating that breaking below $179.30 signals a buy signal failure. A fall to $149.41 is anticipated but not inevitable. The QQQ has merely tested its 2.5-year channel top, holding nicely but now falling away, supporting the $149.41 target as an actionable sell signal. It's suggested that if you've been long and NVDA closes below $179.30, reducing or eliminating the long position should be considered due to increasing downside risk. Closing below $170.76 could trigger establishing a short position targeting $149.41, aiming for a 3 to 5-week objective, with $173.10 as a soft intraday pivot. Failure to close above $179.30 would signal weakness into September. If today's close goes below $170.76 there is a three to five week sell signal to $149.41. The expectation between now and the end of October is $149.41, most likely sooner.