@wickedstocks8906

YouTube

Avg. Quality

81

Success Rate

12.50

Analysis

64

Correct

8

Fail

19

Pending

29

Ineffective

0

Total Quality

Score

If You Had Traded on This Analysis…

Fail

NVDA

Entry

179.8400

2025-08-25

16:47 UTC

Target

149.2900

Fail

179.9400

In 43 Minutes

Risk / Reward

1 : 306

Turn Signals into Profit

Join Tahlil Plus Pro to unlock full performance history, live alerts, and AI-backed risk tools.

Start Free

Final PnL

-0.06%

P/L: —

Turn Signals into Profit

Join Tahlil Plus Pro to unlock full performance history, live alerts, and AI-backed risk tools.

Start Free

NVDA

Fail

Body

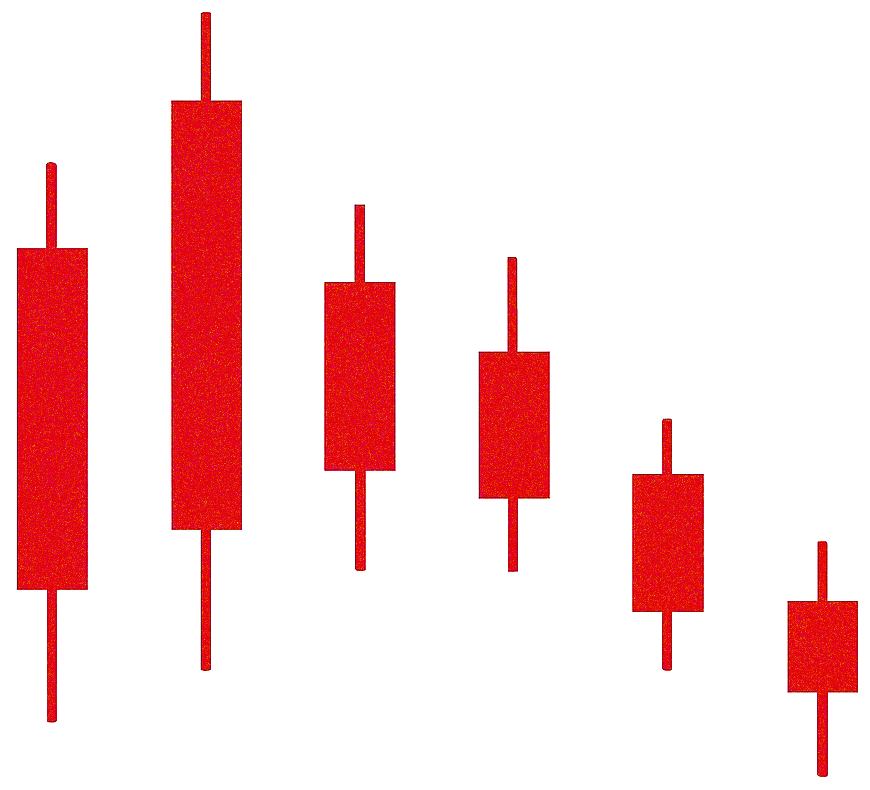

The analysis for TSLA indicates that a Friday rally settled the market above a one-week descending channel top at $324.75, now considered short-term support. A push back into the resistance zone is expected, targeting $349.91, which could combine with longer-term resistance in the low to upper $350s. The $349.91 level was tested previously, and a short position anticipating $308.15 was held. Settling above $324.75 reverses short-term momentum, but a re-approach to $349.91 is possible as a short play targeting $308.15 within two to three weeks, where profits can be taken or a long position initiated, targeting $350 in September. Intraday support is at $331.37, with resistance at $340.84. Breaking $331.37 could test $324.75.

For NVDA, closing above $179.94 exits long-term channel structures. Below this, a fall back to $171.65 is possible in the next few days. Closing below $171.65 signals bearish continuation to $149.29 within three to five weeks. Closing above $179.94 again suggests higher trade, potentially $186.39 by Friday's close. A close below $171.65 signals $149.29 within three to five weeks.